|

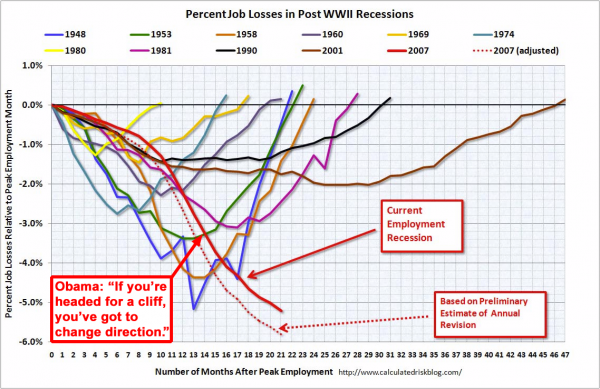

THE LIBERTARIAN ENTERPRISE Number 553, January 17, 2010 "What you really want is to be left alone" Special to The Libertarian Enterprise The author of the Freemarket Gold and Money Report over at fgmr.com, Jim Turk, has adapted the following graphic from available data. Check it out next time you hear that grinding noise from government—the sound of engine parts wearing against each other without lubricant.  Jim writes of his graph, "Note that while spending appears to be leveling out, receipts remain in freefall. With unemployment continuing to rise, it seems likely that this downtrend in receipts will not reverse anytime soon." The level of debt on the scale at right is in billions, so 12,000 represents 12 trillion dollars. That's 1.2 times ten to the thirteenth for our brethren who do math the easy way. I'm not sure this scale is calibrated correctly, since the government does not use generally accepted accounting principles (GAAP) for describing its thefts and deficits. Depending on what you believe about unfunded payments "baked in the cake" with coming decades of socialist insecurity and medi-fraud, the figure is almost certainly upwards of $100 trillion. But the grinding noise is revealed in the rate of increase of debt, which is clearly moving along an exponential curve. Increasing numbers of Americans are out of work, and many who have found ways to hang on are not inclined to file tax papers or do anything to give the government money—which the government will simply turn over to the death merchant defense contractors (about $720 billion this year) or give to the big banks or other cronies. Non-compliance is up and rising rapidly. People don't want to get swine flue vaccines, even though there is an Obama-declared "national emergency." After all, the actual rate of infection is one or two percent in places where the health authorities are bothering to test to see whether seasonal flu or swine flu is involved. That is, one or two percent of flu cases seem to be swine flu—no epidemic at all. Just another big government subsidy to the giant pharmaceutical companies which exist to jump through the hoops set by the FDA as barriers to entry to protect them from competition. So, if theft receipts continue to fall as Americans fail to have the means to pay taxes, or refuse to comply with tax demands, how will these deficits be paid? They will be financed primarily by printing new money, which, in our day and age, doesn't even involve printing paper with ink. Here's another pretty graphic to examine:  Notice that the data runs from January 1959 to December 2009 in the graphic (maybe later if you are seeing this article in February 2010 or later). Notice that for the period to about 2008, the monetary base rises fairly gently, then takes off like a rocketship. From a monetary base (that the Federal Reserve admits to, not that has been audited by anyone, ever) of $200 billion in 1985, the figure climbs slowly to $800 billion in 2006, then in 2008 skyrockets to today's value of over $2 trillion. In other words, $1.2 trillion of new money has been added to the most basic measure of the money supply in a very short time. Where did this money go, and what is it doing? Some of the money went directly to the USA treasury department to buy treasury debt that nobody else in the world would buy. The Federal Reserve has created new money in order to purchase (steal) those bonds. Some of that money went to buy "agency" debt, as well. Agencies like Sallie Mae, Freddie Mac, Fannie Mae, and the VA are involved in student loans and home loans to make guarantees to banks (as an enormous subsidy to the biggest banks) which allow qualifying students and home buyers to get lower (subsidised) rates for their borrowing. However, these guarantees have not prevented defaults. In fact, it proves to be fairly easy to walk away from student loans by moving and leaving no forwarding address, and having a non-profit enterprise pay for utilities using its taxpayer identity number. It proves to be fairly common for Americans faced with mortgages for over-priced homes they cannot meet, and which cannot be sold for enough to pay off the mortgage, to walk away. Which means these agencies have a high and increasing rate of defaults which they have promised the banks to cover. In other words, the Federal Reserve has printed up a lot of money to, in effect, transfer to the biggest banks. That doesn't include the money that the banks have borrowed from the Fed, and it doesn't include the money the banks have been given by the treasury. By some estimates, the banking crisis of 2008 has generated eight trillion dollars or more of subsidy to the bankers. Or we might call them banking gangsters, or banksters. When this process began around October 2008 through March 2009, there was a precipitous drop in commodity prices, as well as stock prices, around the world. Why? Demand dropped a great deal, as the obvious nature of the financial catastrophe caused people to reduce spending, increase conservation measures, take fewer vacation trips, and generally use less fuel and other commodities. Expectation of future demand was also dramatically reduced as the extent of the financial calamity was not at that time known. And, for all that the Fed was printing money like mad, for the first six months of the crisis, it was generally regarded as wiser to be "in cash" and holding dollars than holding stocks or commodities. A lot of value was liquidated. Some of that value has been restored, but it is unclear how the "earnings" which have so far been generated by dramatically cutting costs and laying off workers will be maintained as revenues are dropping sharply for the second year. Doug Casey and others anticipate a drop in the stock market, which seems to have started as of 15 January 2010. (One day of trading does not make for a trend, but the drop was substantial.) Simply put, the economy is grinding down to a lower level of activity, still. Meanwhile, the lag time in monetary inflation has passed and it now becomes clear that fuel prices and other commodity prices are up. In fact, for the ten years 1999 to 2009, the only meaningful profits in any market were in commodities. You should expect to see fuel prices rise substantially this year. A general drop in markets will result in some liquidation of commodities markets, but a flight from the dollar should also be expected. Use dips in gold and silver to acquire more, would be my advice. Ready for more "bad" news? I say "bad" in quotation marks because it is bad if what you value is the old system continuing to sustain ever higher levels of wealth confiscation and global butchery. If you want the system to change significantly, or be replaced, or simply to fail and end on the ash heap of history, this news is not entirely bad. Here's the graphic:  Again, I'm not confident of the scale on the axis at left. John Williams over at ShadowStats.com thinks the jobless rate, using the 1980 method of calculation rather than the more fanciful and capricious methods used lately says that about 22% of the population is out of work. Since he is using the government's data, but not assuming he can discount people who have become so discouraged as to stop looking for work, I tend to think he's got a point. What you will see by comparing the data on the same scale for various past economic crises is that since World War Two, there has not been as much job loss in any other crisis, including the deep but short 1948 crisis. This chart also shows no clear bottoming out. The latest unemployment calculation on Shadowstats.com suggests a possible flattening of the unemployed curve. Now, make no mistake, there is tremendous suffering involved in being out of work. But there is also a very large grey market and an even larger black market. People who are not employed by a company which has demanded a W-4 and I-9 form may still be getting money. They may be engaged in agorism, buying and selling in the free market. They may be engaged in proscribed activities such as gambling, prostitution, recreational drug sales, and other contraband trading. And they may be making some headway against their obligations so that they aren't really motivated to get a "regular" job and pay regular withholding taxes. If you have been thinking about leaving the mainstream economy, this might be an excellent time. Instead of getting a job and reporting your income, consider starting a business or a non-profit that never makes any earnings. If that business also doesn't employ anyone, there are essentially no forms to fill out, no taxes to file with the feral gummint. In some states, there is no sales tax. In many, services are not subject to sales tax. Think about changing location. If you have been filing taxes with your home address for years, you can expect the IRS will send angry letters. If you ignore them, they might also send angry visitors. Meanwhile, home prices have dropped many places, so you may find it easy to get into a new location. Why hang around for the aggravation? When you do change address, get a UPS store or other private mail box. Don't give the ferals an easy skip trace. Keep your utilities out of your name for a few years by using a business entity or non-profit. Many states let you form a new non-profit for about $25. That entity can have a bank account, purchase utilities, own or rent property, do all manner of things. Consider the advantages of a pre-paid phone card or cell phone, which does not tie to your identity or living space. Many banks have failed, and more are expected to fail this year. It might be wise not to work with banks any more than necessary. Banks exist because of a license to commit fraud—to lend out money they say is available to you on demand. In the case of the very biggest banks, the reserve requirement can be tiny, allowing nine or ninety dollars to be lent out (depending on leveraging and derivative exposure) for every dollar on deposit. Cash might be better. Gold and silver would be much better. For one thing, banks will turn over your money to the IRS without a court order, with only a "notice of levy" or demand letter. They are much more concerned about protecting their relationship with the government than their relationship with you. If you do have business needs that involve banking, look at the bank you choose to use. Big national banks are likely to be nationalised. They are also at the heart of the financial crisis, so pulling your deposits out of their banks and canceling your credit cards with them might be just. They also have very high Texas ratios and other signs of instability. Consider a local bank in your state or county. They money you save may be your own. Fees are likely to be much less, the funds you spend are more likely to be lent to local businesses, and the profits are almost certainly going to be lower—so fewer huge bonuses are coming out of your hide. It is early days, still, for the alternative money industry. Not too early, though, to become familiar with Trubanc.com, Loom, WebMoney, Pecunix, c-gold and other systems. Talk to your local currency enthusiasts and consider minting your own silver pieces. One of the main advantages of contemporary civilisation is information. We can find things out very quickly. The great equaliser of force is the hand gun. The great equaliser of knowledge is the Internet. The more you know, the better. Many years ago, physicist Gerard O'Neill, the famous author of books about colonies in space, addressed a Republican congressional caucus meeting in Houston by videotape. I had the opportunity to watch his address. Dr. O'Neill explained that a physical system becomes more rigid right before it fails. When it is at its most rigid, ever, it is very likely about to fail. Which point he used as an analogy to the situation with NASA at the time (1993). I think it applies to government generally, today. An SF writer was recently beaten and arrested by border thugs while leaving the USA. Airport security has been wild and bizarre since 2001. It is getting more weird every week. The government is increasingly desperate, lashing out in Iraq, Afghanistan, Somalia, and lately Yemen. It is trying to hold onto 805+ military bases in over 130 countries, including dozens in Iraq and Afghanistan. It is cracking down on taxes, on regulations, on protestors (see the G20 riots in Pittsburgh). The police are proudly getting up early to "beat the crowds." Taser use and police involved shootings are on the rise. Those who crave power will use brutality and other means to keep it. Authoritarianism, which we all hate, is a symptom of that rigidity which O'Neill says we should look at as a sign of failure. The system is grinding its parts together. Take the opportunity to withhold lubricant. Let the grinding get worse. Meanwhile, look to your families and neighborhood. Tend your own garden. Losing your house isn't such a bad thing if it lets you set your household in better order, provide for greater personal privacy and more independence. Losing your job can be a very good thing if it removes your income from the tax rolls and leads you to take charge of your own destiny. The system we live under and within cannot sustain itself. As retired statist whore Maggie Thatcher once said (probably quoting FA Hayek), the problem with other people's money is eventually you run out of other people to rob. Don't let the grinding noises bother you. And don't let the bastards grind you down.

TLE AFFILIATE

|