|

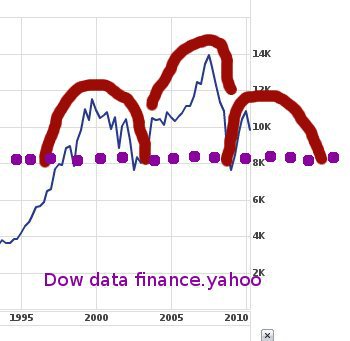

THE LIBERTARIAN ENTERPRISE Number 574, June 13, 2010 "America didn't have a drug problem before it passed drug laws." Special to The Libertarian Enterprise My recent comments on the train wreck of European sovereign debt reaching Hungary have brought up some questions about what investors might be able to expect in the next decade or so. Personally, I have been out of the blue chip stocks for many years and don't anticipate getting in on the terms currently on offer. However, many people I know have investments in stock markets in the USA and elsewhere around the world. Some have company pensions, 401K funds, Roth Individual Retirement Accounts, and other expectations of future profit from stock market meanderings. Over the course of the last twenty-five years of writing business plans and essays about politics, economics, personal sovereignty, and freedom, I've been asked again and again to offer insights on what people may expect. In short, I've been asked to anticipate market behaviour. And I've done it, despite misgivings. Let me go over my misgivings first: You are reading this essay without paying for the advice, and I cannot guarantee that the advice in this essay is worth even what you are paying for it: zero. I make no warranty of fitness for use for any purpose. I have no crystal ball. I cannot see the future. My track record for anticipating future events is not noteworthy except for being completely wrong. You should not rely upon what I write for any purpose. Even using what I write as a direction for further research and inquiry on your part might not do you any good. So if reading this essay isn't fun, amusing, or delightful, then please stop reading. Nothing to see here, move along, move along. Over those years I've developed some rules of thumb about what I think works and doesn't work. Here are some of them: 1. If you are investing to gain a tax benefit, you shouldn't invest. Tax benefits are not permanent, are as fickle as the politicians offering them, come and go without warning, and in the current environment may be subject to ex post facto implementation. You may lose the investment benefit you were anticipating back to the date of your investment, without warning. A corollary of this point is: never borrow money to invest. If you borrow money to invest you can lose more than the amount you had available to invest. 2. If you are investing with the trend, you should be watchful for trend reversal signals. Despite the pronouncements of a great many believers in singularities, especially market singularities, very few things go only one way forever. Prices go up, prices go down. Most price levels revert to trend. If the trend for manufacturing stocks has been a price about five times earnings and you buy when the price is 15 times earnings you may be disappointed that the stock never reaches a price of 30 times earnings, but instead descends to five, or three, or less. 3. If something seems too good to be true, chances are really good that it is not true. Bernie Madoff and the Social Security Administration have much in common. 4. Markets are like other games in having a very substantial psychological component. Understanding the psychology and expectations of the other players at the table doesn't mean buying into their beliefs and plans. It means knowing how they are going to bet based on what they believe. This approach works with poker in that you don't have to know how the cards have been dealt, you have to know how the other players have reacted to the cards they have held. Once you understand the other players at the table you can figure out who is going to be losing most of their money. If you look around the table and you can't figure out who is the big loser, it's you. Cash in your chips at that point and go do something else. You'll get more satisfaction out of drinking your money. 5. People seem to have been engaging in trade and commerce for as long as we have had written records, and for periods significantly before writing. We think the earliest cities were built on sites valuable for materials like obsidian or copper ore. We think the earliest artefacts include bones with tally marks for counting objects like herds of animals. Among the very earliest surviving forms of communication are cave paintings from around 25,000 years ago, which illustrate herds of animals that may represent a chart of the stars. So, mankind has been all of us in the gutter, with some of us looking at the stars for a very long time. Over those tens of thousands of years, judging by the things that people who did well economically in life are buried with, items like gold, silver, and copper have always been valued. When you are confronted with a trend 25,000 years long you would be unwise to buck the trend and go for, say, paper currency. One of the applications of rule of thumb number four is that technical analysis is meaningful to a large number of market players. So when you see a chart formation that indicates a reversal of trend, even if you don't believe in charting or technical analysis, you should expect that the other players in the market are likely to behave consistent with their beliefs. And while I personally feel that charting is all nonsense, that clouds form more convincing horses and bunnies without being able to give me a ride or a meal, what I feel about charting isn't what affects markets. Market behaviour is driven by the ideas of market players, and I'm not a big player. So what about this formation:

Well, if you want to understand that formation, you want to know what other investors, other players at the poker table as it were, believe about that formation. Here are some clues: Now, I don't believe any of the things written about that chart formation. But I'm aware that a large number of people who are active in the markets do believe those things. The one thing that I do believe that appears on either of those links is: "trading carries significant risk and you can lose some, all or even more than your investment." That's true because you can trade using debt instruments like margin, and if you trade on margin you can lose more than you have invested. Did I mention that the rule for not investing to gain a tax benefit also applies to not investing with money you cannot afford to invest? Don't borrow to invest "on a sure thing." The only thing you can be sure of is the number of people who have lost their money investing on a sure thing is larger than the number who have made enough to service the debt on the money they borrowed in order to invest. Now, if you look at the long term trend on the Dow from 1930 to 2007 you can see that it is basically an upward trend. Which means that the head and shoulders pattern which I suspect is going to complete over the next three or four years is a trend reversal pattern. But it might not be—volume should have decreased on reaching the peak price of the head in 2007, and instead it increased. Volume was lower on the left shoulder than it is now on the right shoulder. Trading volume should follow the pattern of the head and shoulders formation, and it doesn't. So, this whole analysis could be completely wrong. And remember that my suspicion that the market is going to behave as though tens of millions of investors believe a head and shoulders trend reversal signal has been started and is going to complete does not reflect any underlying belief on my part in charting. But, what the hell. It isn't like the markets offer a lot of other signals on what to expect. Since the right hand shoulder of this formation is not yet complete, and, indeed, seems to have barely gotten started, it is far too early to say what overall trend is likely to re-assert itself. So be watchful for prices below 7,600 on the Dow to see whether there is an uptrend or a downtrend neckline. I think, based on what has happened so far that the right shoulder is forming a tiny bit higher than the left shoulder. Compare 7591 to 7608 as low values thus far shown on the left and right shoulders, respectively. Which means that after the completion of this trend reversal signal there may be an overall up trend that re-asserts itself. However, that is years in the future. As a trend reversal pattern, the expected value is that the trend, which was up from about 1930 to 2007, on average, is not going higher. It is going to reverse and go lower. How much lower? Well, if the events of 2007-2009 are similar to the bursting of the South Sea and John Law money bubbles of 1722, then we can expect the Dow to plunge to about 5% or 10% of its high. Which would be 695 to 1390 on the Dow. If the Dow were to plunge that low, today, it would approach one ounce of gold or less to buy the Dow. Which figure seems to be a re-set value of sorts. In 1999, it took over 42 ounces of gold to buy the Dow. Today it takes less than 8 ounces of gold to buy the Dow. So in inflation-adjusted currency, it seems that 1999 was the secular peak for stock prices. During the twentieth century, the ratio of gold to buy the Dow was less than 3 ounces on at least nine separate occasions. So, if you are a speculator or trader there may be an opportunity to continue trading stocks during the next few years of volatility. But I don't think there is anything fundamental about the market that makes stocks exceptionally valuable at current price to earnings ratios, at current dividend yields, or at current currency valuations. You would very likely be better off owning other things of value, such as gold coins, silver coins, ammo, food, farm land, and the like. What fundamental factors would need to change substantially in order to look for another secular bull market in stocks? Remember that we've been through this situation before, more than once. Between 1960 and 1980, gold and silver prices surged dramatically. Deficit spending and inflation became major concerns. In 1980 the value of gold and silver dropped significantly. About two years later, in 1982, stocks began rising in a secular bull market that lasted, using gold as the measure of value, until 1999. In other words, you could have spent the last fifty years making just three investment decisions, and you would have made an enormous fortune. If you had taken your money overseas and bought gold between 1960 and 1980 (Americans were not "allowed" to own gold in the USA from 1933 to 1975) then sold during 1980 and bought NASDAQ composite stocks and held them until 1999, then sold and bought gold again, you could have taken a fortune worth $35 in 1960 (about one ounce of gold on the market then) and turned it into a fortune worth in excess of $100,000 today. Gee if you had only known. Price to earnings ratios should revert to trend, and below, before stocks should be regarded as a suitable investment. For manufacturing companies, a price to earnings ratio of 5 to 10 is normal. For high tech investments, a price to earnings ratio of 15 to 20 is normal. Stock prices should be significantly below these values in each case before you get back into stocks. Dividend yields are starting to come up above 6%. Take the annual dividend payment and divide by the stock price to get the dividend yield. For example, AT&T was recently showing a dividend yield of 6.9% and a forward price to earnings ratio of about 10. [link] There have been extraordinary situations, for example when the tobacco industry was being hit by politically motivated attacks, when some stocks have traded at or below dividend yield. Assuming that the political situation doesn't utterly destroy those companies through outright confiscation, you might do well to invest at that price. But a significant factor in all investment decisions is the nature of the market where you are trading and the currency in which trades are denominated. In the USA, you face an increasingly militaristic, fascist, authoritarian super state with delusions of grandeur. As long as the USA is operating 800-plus military bases in 160-plus countries, as long as it is running a trillion-dollar-plus annual budget deficit, as long as it is managing a 13 trillion dollar plus national debt, and as long as it continues to pretend that it can confiscate sufficient wealth to make good on unfunded future obligations in socialist insecurity and medi-scare, and an enormous trading deficit, you should expect the value of its currency to be subject to change without notice. It does you no good at all to invest in a dollar denominated stock with a 10% dividend yield if the value of the currency it yields becomes worth 1% of what it was a year ago. And hyperinflation can be tricky that way. Look at Zimbabwe 2002-2008, Yugoslavia 1993-1995, Weimar Germany 1919-1923, the French assignat and mandat of 1790-1797, or dozens of other examples. What usually happens when a currency hyper-inflates is economic disaster followed by tyranny. There are some reasons I believe that won't happen this time, exactly. But if you aren't prepared to avoid government and resist tyranny, you may become a victim of government brutality. Which would be sad, because after the difficult time in our immediate future, the rest of this century looks to be amazing in terms of new technologies, access to the planets, and much longer life spans. So if you want to reach the bright shining future ahead of us, make plans to survive the next few years. You'll be glad you did.

TLE AFFILIATE

|